The following opinions are the research results of a well-known international management consulting organization and are for reference only, and do not represent the views of Hay Think.

Hay Think has simpler, more scientific and practical management tools, which are being used in the world's top 100 multinational groups.

Successful elements of supplier relationship management

After a long-term development and evolution of supplier relationship management, the theoretical improvement of professional consulting companies and the practical verification of advanced manufacturing companies, we can summarize it as:

Nine cooperation modes with suppliers

Found the secret to real-world supplier relationship management. Each of these models involves the core content of effective supplier relationship management.

We rely on a variety of products and services from our suppliers to succeed, but we know very little about supplier relationships, or how to leverage them. Some people think that the purpose of managing supplier relationships is to cut costs, while others believe that supplier relationship management is nothing more than the sum of various category management initiatives they have tried.

We believe that suppliers and their relationships with suppliers have not yet been fully explored or utilized. At a recent roundtable of purchasing management executives, several purchasing directors from Fortune 500 companies stated that managing supplier relationships effectively is one of the biggest challenges they face, and they have not yet fully addressed this challenge ready.

Supplier management is a cliché, and identifying supplier characteristics related to a company's business goals is a new issue.

Seizing the core of supplier management

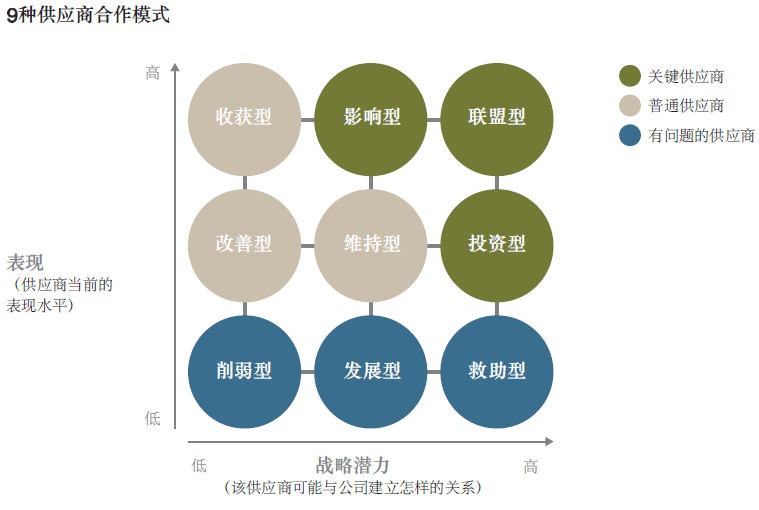

A closer look at the supplier relationship reveals that it has several models. Regardless of industry, company size, and many other factors, suppliers can be divided into different types.

Some of them belong to "core suppliers", and by developing strategic cooperative relationships with them, they can enhance their competitive advantages.

There are also "important suppliers" that provide only the general products and services needed, which are also available from other sources.

In addition, there are some "problem" vendors that, although capable of providing useful resources, may cause serious problems that need to be addressed or even replaced.

Of course, supplier relationship management is not new. But our system for identifying vendor characteristics needed for a company's specific business goals is new.

What is the core nature of supplier relationships?

How can you better use this relationship to make your company successful?

What is the demand of the supplier?

How do we tell our suppliers where they are now and what we expect of their future services?

This last point is particularly important because supplier relationships are rarely structured effectively and provide guidance for some internal communications and planning, or communicate where practical.

This is the premise of designing nine kinds of supplier cooperation methods-identifying the secret or unique model that can reflect the real supplier relationship management.

Each model can directly explain the core of the most common and effective supplier relationships, and at the same time determine the capabilities expectations of each supplier, laying the foundation for future common success. Traditional procurement is irreplaceable. Through our supplier management approach, companies can find and support supplier relationships that can generate the greatest return on investment.

Next, let's dive into nine models of supplier relationships:

Key suppliers: focus on training

We first delve into the most promising suppliers. Whether it is a supplier that has established a good relationship, or a supplier that needs a little effort to clearly establish a good relationship, it is very valuable to the company and it is worth your time and energy.

Integrate suppliers-worth the promise

In this case, the goals of the supply and demand sides can really be merged together, and the two parties work together to achieve these goals. This partnership is usually represented by the capital letter "P". Although it is an overly commonly used term in the business world, true partnerships rarely exist and require you to establish a differentiated and comprehensive relationship with your suppliers after many years of effort to build an ecosystem that can shape the market. The supplier selected under this model should best meet the company's business goals: its performance should be free of defects, and it can create revenue and profit growth opportunities while shaping or reshaping the industry form1. Key competence.

Establishing and maintaining strong relationships in an alliance-based supplier management model requires significant investment from both parties. It is important to understand that the suppliers who invest in this model take considerable risks. It provides you with a high degree of concession while limiting its own growth potential. Similarly, adopting this highly integrated, centralized relationship also means that your company's number of suppliers will be very limited.

How to work with an affiliate supplier:

Establishing a successful relationship with this type of supplier depends on the willingness of both parties to operate as a consolidated, smooth-operating company. You can encourage the company's departments, functions, and levels to align with suppliers in meeting needs, budgeting, and timing. This model works only if both parties can achieve profit and revenue growth and growth benefits. This means that both parties should pay attention to the changes in market trends and changes that may have an impact on partners. For example, if a competitor of your company's affiliate supplier offers the same product at a lower price, you should negotiate with the supplier to meet that price. This may be achieved by adjusting product specifications or increasing production efficiency and constantly exploring common cost reduction opportunities. If both parties can understand each other's core competitiveness, they can avoid the emergence of duplicates.

Influence supplier-joint development of new products / services

Suppliers that fit this model can provide near-perfect products or services. Compared with other suppliers, their difference is that they can jointly develop new products and services with the company, providing the company with innovation space. This can shape the relationship between the company and the supplier. These vendors often dominate an industry because they are few in number and crucial to a company and its competitors. In turn, these suppliers will not favor a particular customer, and in the case of a supplier monopoly, the law does not allow them to do so. Of course, the disadvantage of this model is that with them, it is almost impossible for the company to surpass its competitors. In addition, if the relationship is not managed properly, the company may be alienated from these suppliers, thus lagging behind competitors who have a good relationship with the supplier.

Positioning of suppliers on the curve of performance and strategic potential

Although the term and concept of supplier relationship management (SRM) is common, there is still no common definition.

The core of SRM is:

• Promote supplier behavior

• Around the relationship between two companies

• Enable companies to make the most of their scale by coordinating departments, functions and levels

Next, we tested a practical structure with our customers, distinguished various supplier relationships, and focused on current performance and the future strategic potential of the relationship.

The two axes are defined as:

• Performance

Current performance is measured by output over a period of time (such as the percentage of orders completed in full and on time), cost (such as savings compared to the previous quarter), and quality (including defective rates). Capabilities are measured by their performance in engineering, procurement, manufacturing, supply chain management, sales, marketing, and finance.

In fact, supplier performance is often measured based on a set of output and input factors.

• Strategic potential

It is the future strategic potential of the supplier, and its value cannot be measured objectively. Factors to consider include: the uniqueness of the product or service provided (the strategic potential of a monopolistic supplier is relatively high by nature), the size of the business with which the supplier works (the suppliers that are important to all sectors often More valuable than other vendors), "business" potential (suppliers may have some

Realizing the key potential of future plans), attitude (honesty and reliability are very important).

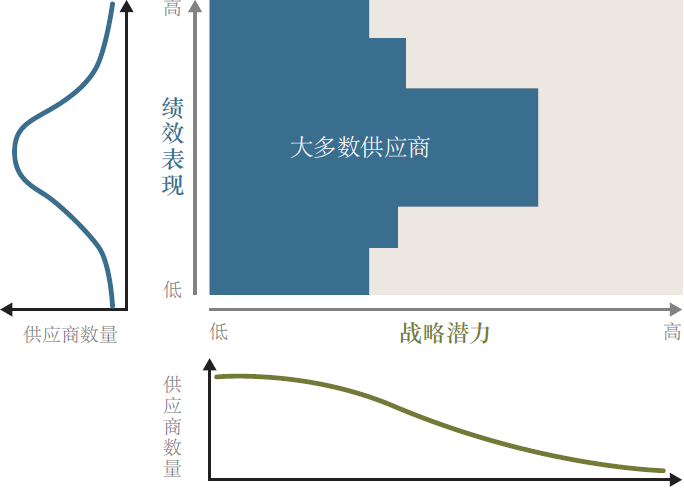

In reality, the distribution of suppliers on these two coordinates is not linear. As shown in the figure, the distribution of suppliers on the performance performance coordinates is bell-shaped or too distributed.

The performance of most suppliers is average. In terms of strategic potential, the distribution is more inclined to the left, that is, most suppliers will establish mature relationships with the company and will not cause abnormal events in the short term. However, there are also some suppliers with particularly great strategic potential.

Looking at the overall situation, a new model is beginning to emerge. Most suppliers will be located in the center to the left, and their performance is in the middle, with mature strategic relationships. There is

A small number of suppliers are located in "areas of interest". This distribution will directly raise questions about how to interact with these suppliers.

How to work with influencers:

Dealing with relationships with influential suppliers is just like dealing with most relationships in our lives. Grasping good timing and regular communication is important to take advantage of opportunities. You need to set expectations in advance, which requires authority to understand the vendor's products, technologies, processes, and innovation paths. Evaluate suppliers, explore cooperation opportunities, and even explore areas where limited franchises are available.

Suppliers are required to provide continuous feedback to understand whether the company's activities and plans are in line with the suppliers to achieve reciprocity, and then negotiate competitive pricing accordingly. In addition, influential supplier relationships require a large amount of internal resources, so mutual encouragement is needed to increase confidence in each other's plans and get a corresponding return on investment.

Invest suppliers-believe in their strength

Does your company have a supplier who has good ideas and innovative capabilities but is plagued by basic issues such as how to ensure continuous supply or consistent quality? These suppliers may have very good prospects-they may eventually become affiliate suppliers, but whether their potential can be realized depends on how your company currently builds relationships with them and how responsive they are. Ideally, the investment supplier eventually grows into an alliance supplier, and can work with the company to build the capabilities needed to become an alliance supplier. In this case, we recommend that you invest your time, money, and resources to help the supplier build the ability to meet your company's needs and cultivate relationships with that supplier. Companies that are best suited to become suppliers of this type should be able to prioritize capacity building. But be aware that some vendors may refuse such help because they think you are trying to turn them into "captives" and lose more market opportunities.

Clarify the responsibilities of all parties and reduce confusion.

Investment supplier relationships may be widely accepted in an industry. For example, in the field of aerospace, it is common for customers and suppliers to jointly participate in new projects through the cooperation of risk sharing and revenue sharing. Both parties share development costs and share returns.

There are also examples in the automotive industry

When BMW contacted SGL Group to develop lightweight carbon fiber reinforced plastics for its new i3 electric vehicle, SGL recognized that this was a valuable opportunity to establish cooperation with BMW. The two companies jointly funded the establishment of an advanced plant in Moses Lake, Washington, which produced body components that could reduce the weight of the new electric vehicle by 550 to 770 pounds, offsetting the weight of the battery. The joint venture between BMW and SGL is a pioneer in the use of carbon fiber for mass production of automobiles and a milestone in the automotive field.

How to work with investment suppliers:

The key to this cooperation model is to find a balance between cultivating suppliers and gaining supplier trust, eliminating the worry of being swallowed. Supplier concerns can be reduced by developing transparent cases in which both parties are involved. Cooperation should bring attractive investment returns to both parties. In addition, it is important to stick to your supplier's commitment to reduce supplier risk, as this will deepen the supplier's commitment to your company. Since this model requires close cooperation between the two parties, it is also important to clarify the responsibilities of the parties and reduce the confusion of the terms of cooperation.

General supplier: keep the status quo

There are a large number of such suppliers and don't be fooled by their average status. The number advantage is huge. As the number of ordinary suppliers in your company's field increases, companies can gain in-depth results by using a simple tool to maintain or gradually improve supplier performance through a deep understanding of how such supplier relationships work.

Harvest suppliers-although highly efficient, they still need to be nurtured

Harvest-type supplier relationships mean that both parties are in good operating conditions. The products and services provided by the supplier are exactly what the company needs, and they are almost perfect, which will help the company improve its competitiveness. For companies and suppliers, this relationship has almost no disadvantages and does not take up much resources. Here we need to be vigilant about complacency, which is a red flag. Good performance is not the same as good partnership.

Therefore, we recommend using the term “partner” with caution, as it leads to the assumption that no change is required. A lower investment in resources may convey the message that you don't pay enough attention to your relationship. If the supplier is hesitant, your relationship may be abandoned. The vulnerability of harvesting suppliers, and the lack of discussions on how to maintain performance between the two parties, may lead to tensions in the relationship between the two parties and negatively affect their interactions.

The challenge for the average supplier is to find the balance between investment and return on this relationship.

How to work with harvesting suppliers:

As long as two things remain the same, harvest-type supplier relationships can bear fruit.

The first: suppliers can maintain their performance. Make sure the supplier understands "choose it" because of its good performance, not because of your relationship. It is definitely a mistake to tell a harvesting supplier that it is a company's partner supplier.

Second: Ensure that suppliers are provided with all the support they need to maintain current levels of products and services. As long as these incentives do not require the company to invest additional time and resources, this harvesting relationship can be maintained. If the situation of the supplier changes or hesitates to maintain the relationship between the two parties, then some specific measures can be taken, which we will discuss briefly.

Sustainable Supplier-Strive for Continuous Development

The company may have many sustaining suppliers. Although they are mediocre, after many considerations, the company will put these suppliers on top of most other suppliers, usually because the company needs these relationships to continue. These vendors don't need a lot of maintenance or guarantee a large amount of investment. But in order to gain more value and move towards world-class performance, it is best to take incremental improvements.

How to work with sustaining suppliers:

The key challenge in this type of relationship is finding the balance between investment and return. When these suppliers realize why you value cooperation with them, they will not be so complacent, thus preventing their performance from dropping or proposing less satisfactory commercial terms. Treat maintenance suppliers fairly at all times, but not take up too much resources. This type of supplier relationship may have maintained a reasonable distance, and suppliers need to compete for more business. However, in this regard, the company should pay attention to the changes in the market and performance may cause the relationship to change. Maintaining close relationships with suppliers helps the company understand the market dynamics and take corresponding actions.

Move

Improve supplier-resolve defects

Most of the company's suppliers may fall into this category. Their performance levels are similar to maintenance suppliers, and their disadvantages are similar. The biggest difference between these two suppliers is that when the improved supplier fails to meet the requirements-especially in the case of repeated failure to meet the requirements, the company is more likely to replace them, unlike the maintenance supply. Shang was so hesitant. As a result, improved supplier relationships are less stable for both companies and suppliers. Companies can help improve suppliers improve their performance, turn them into harvesting suppliers, and turn unknowns into opportunities.

How to work with improved suppliers:

As long as improved suppliers do not require a lot of time and other resources, the company will give priority to these suppliers to overcome their shortcomings, rather than directly replace them. Clearly telling suppliers how they should work more efficiently is a direct indication of their future strategic potential. Otherwise, these suppliers will not have a true understanding of the actual situation and cannot improve their performance, causing the company to change suppliers and make the company spend more energy.

Problematic supplier relationships: it's time to take a major fix

Rather than remorse for hiring certain suppliers, think carefully about what went wrong and learn from it. It's time to control your losses, and it's also a good time to repair those supplier relationships that guarantee investment. If the two parties decide to part ways and find a better partner, then at least the smooth flow of communication must be guaranteed.

Mitigate Supplier-Harmonious Dissolution

Sometimes, some supplier relationships simply cannot be maintained. It always has major problems, such as delivery, cost, quality, etc. The company needs to find more promising new suppliers. But companies must consider mitigating the risks and consequences of changing suppliers. If the relationship with the supplier is at this stage, and the unqualified supplier is small or the business structure is simple, the company will be easier to transition. However, if a long-term cooperation with a supplier has multiple business lines and product categories, or there is a large-scale outsourcing agreement, then changing the supplier will face new challenges. Paradoxically, although the relationship with the supplier is about to end, as long as the cooperation continues, the relationship will remain important and the quality of its interactions needs to be maintained.

How to work with mitigation vendors:

Start with a transition plan to avoid misunderstandings and even disasters. The supplier should perform all of its outstanding business responsibilities and clearly identify the steps to hand over business to the new supplier. Large suppliers should use this preparation as part of continuous risk management.

During the transition period, companies should ensure that they understand the internal working principles of mitigation suppliers, like the transparent backs of pocket watches. Have suppliers present the company with all the latest details on phasing out all product categories and business lines. Learn about the interrelationships of these product categories and business lines and their impact on your company. Some processes and services may not be so obvious, so it is best to do an in-depth evaluation. Development scenarios and business cases, including action simulations, can help predict supplier responses and generate valuable input. The company's senior management and key stakeholders should draft exit strategies and inform all personnel. This will help control communications and suppress them before conflict information erupts.

Finally, do not define mitigating supplier relationships as permanent. Actively maintaining contact between the two parties may allow them to re-establish supply relationships when conditions change. After all, this supplier has a very deep understanding of your company's business and may be helpful for future development.

Develop suppliers-create the ideal source of supply

For areas that do not currently have competitive advantages and operational benefits, companies can consider establishing developmental supplier relationships. These vendors are currently underperforming and need to be improved. Such suppliers should be carefully selected, have great potential to establish close cooperation with the company, and be able to tap opportunities in the value chain of both parties. Contact the company's internal cross-functional team to identify qualified candidate suppliers who have not yet reached the golden stage, but they have the potential to become star suppliers. In well-managed relationships, there are many examples of developmental suppliers growing as a major source of supply. For example, many manufacturers train their suppliers in low-cost countries, provide them with technical or engineering assistance, and speed them up to become component suppliers for the company.

How to work with development suppliers:

This type of relationship applies to suppliers who see your company as a unique opportunity for their own advancement and are willing to execute the contract in accordance with your company's development plan. These vendors should be able to work with the company in a fully open manner. Start a dialogue between the two parties by providing business cases and plans that are in the interests of both parties, including explaining the company's purchase volume allocation to suppliers. The purpose is to facilitate suppliers to adjust settings and processes. We recommend the introduction of engineering, production and quality standards, as well as strong project management supervision. The planning and implementation work requires both parties to release core resources, and it is best to cooperate with each other to manage the project and exert influence on the functional departments. Finally, with the same goal, the two parties involved each employee involved in the new relationship to participate in the MBO to monitor performance.

Bail out suppliers-use when intervention is necessary

If a major supplier makes a big mistake or an ongoing problem needs urgent resolution, a rescue supplier relationship can be formed unexpectedly. This situation could threaten supply and severely harm the company's business.

The near-term goal of this supplier relationship is to stabilize the performance of the supplier, and the long-term goal is to summarize the lessons learned and avoid remedial measures for the supplier in the future. Although it may seem counterintuitive, this relationship is likely to be maintained, especially for important suppliers. Rescue supplier relationships should be short-lived and rarely happen, and they should be temporary measures to improve overall supplier relationships.

How to work with a rescue provider:

Recognizing relief directly and quickly can minimize losses and save supplier relationships. The supplier should acknowledge the severity of the situation and allow your company to step in, which can lay the foundation for the next key steps. Reversing the situation requires joint efforts from both sides. Your company should provide specific guidance and require suppliers to fully follow these guidelines, including finding solutions to problems. Relief measures are generally not implemented in your company, but almost all are implemented at the supplier. Therefore, send someone to the supplier as soon as possible.

The emergence of emergency rescue situations often poses unprecedented challenges to your company. In order to respond quickly and effectively, it is best for the company to establish emergency relations with third-party experts in advance. These additional resources can then be used to help resolve the issue. Rescue measures are expensive for each party.