If retailers see indirect costs as opportunities for business transformation, not just procurement issues, they can increase sales returns by 2%.

For retailers seeking to cut costs and increase investment, indirect spending can be a potential untapped opportunity. Indirect costs-goods and services that retailers buy but no longer resell-average 10% to 15% of sales, and most retailers know that their indirect spending is far from optimized. While recognizing the potential is easy, capturing these cost-reduction opportunities proves to be very difficult.

Challenges are not new. They include a lack of spending visibility, fragmented ownership and spending authority, a lack of incentives to reduce indirect spending, and an isolated approach to sourcing non-selling (NFR) categories. In addition, indirect procurement typically focuses on negotiating prices with suppliers rather than using more influential opportunities to optimize what and how retailers buy. Our research also shows that retail NFR procurement capabilities and resources are significantly weaker than many other industries: NFR goods and services are considered far more important than resale products, so NFR purchasers tend to receive less management attention and fewer Investment in talent. In addition, even NFR procurement professionals often do not have expertise in the NFR category. Rarely is the procurement team, who have an in-depth understanding of elevator maintenance or marketing agency management costs.

However, visionary retailers are adopting a new approach to indirect expense management with fundamental results. These retailers do not view indirect costs as merely a purchasing function. Instead, they want to change indirect spending across the business. They overcome challenges by leveraging three new ways of working: a cross-functional approach, leveraging demand for specific categories, using digital and analytical tools, and strengthening supplier collaboration. They are taking concrete action to change thinking and behavior.

In doing so, the retailer's indirect spending has been cut by 10% to 15% per year, and the return on sales has been affected by 1% to 2%, and the NFR purchasing team's cost-to-return ratio has exceeded 15 times. We've found that the value of the retailer's benefits is very consistent-even for companies that have long been committed to reducing indirect costs, whether internally or externally.

Business transformation

To get the most value from a cost reduction plan, retailers must carefully consider the scope and target level of the plan. Broad scope and high goals are integral to true change efforts.

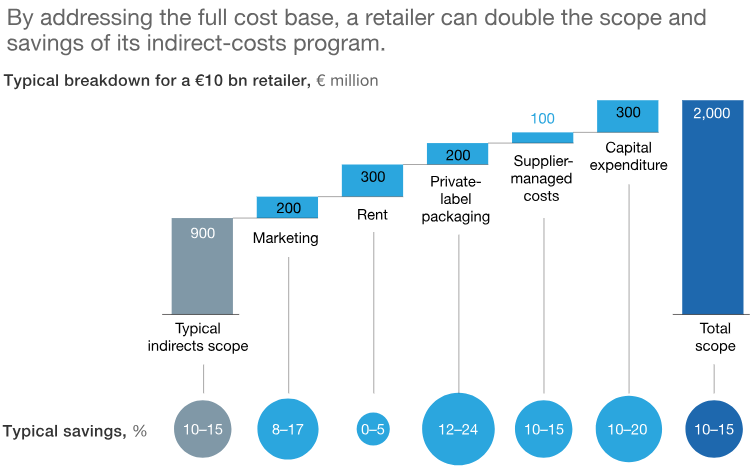

Historically, retailers have cut costs primarily by reducing store labor or travel expenses. Few retailers have realized the full potential of optimizing NFR spending for non-selling products (see chart below). In addition, even when retailers explicitly seek to reduce indirect spending, sometimes they limit certain cost categories to "unclassifiable." For example, some retailers consider marketing spending to exceed targets, arguing that marketing is critical to the core business of the retail industry. Other retailers are also not planning to try to reduce rents because they believe they cannot renegotiate terms unless they are in financial trouble. Some indirect costs-such as supplier-managed logistics-remain un challenged because they are "hidden" in the cost of sales. Some retailers only look for opportunities to reduce costs in operating expenses, keeping all capital expenditures unchanged-even if the latter usually has a higher potential for cost savings (as a percentage of cost).

Bypassing these categories, retailers are losing more than half of their potential cost reduction impact and missing out on the synergies that large-scale projects can bring. To achieve change in indirect spending.

Another thing that transformation projects must do: set development goals that stimulate creativity and get out of the box. To determine its NFR goals, a retailer first conducted a fact-based diagnosis advocated by senior leaders. This exercise helps organizations understand that the plan is a priority, adopting a transformation rather than an incremental thinking model, and focusing on how to achieve the goal rather than trying to change it.

New way of working

Viewing NFR efforts as a business transformation is a key first step. To maximize NFR savings, retailers need to adopt three new ways of working.

A cross-functional approach that includes demand leverage for specific categories

The shift in indirect spending will require more than the involvement and commitment of purchasers. Cross-functional teams can break the silos, raise serious questions about what the business really needs to solve, and make balanced trade-offs.

Cross-functional teams can provide basic supplier management leverage (such as competitive bidding and supplier integration) that affects retailer buyers and prices. The team can also extract process management leverage, which affects how retailers buy: if features are in compliance with purchasing policies and only preferred suppliers are used, spending outside the purchase contract will be reduced or even eliminated. It's easier to track savings across your organization. Retailers can better negotiate supplier payment terms and recycle benefits.

Most importantly, cross-functional teams can better select demand management levers for specific categories, which affects what retailers buy. In our experience, these leverages can provide up to half of the potential savings for established companies-and even more, as negotiating lower prices can lead to diminishing returns over time. The biggest opportunities are often areas that many retailers consider to be out of scope, such as marketing (for example by using a return on investment method) or logistics (using leverage such as reducing inventory or network redesign).

A retailer seeking to optimize logistics spending required a cross-functional team to redesign its distribution network. The team reduced end-to-end costs by selectively increasing certain logistics costs. For example, it can change some of the delivery methods from sea freight to air freight to improve sales performance and reduce price reduction opportunities. It also increases the frequency of delivery of certain products and stores.

Using digital and analytical tools

Digitalization has revolutionized every business process and will continue to change our lives, and indirect procurement is no exception. Today, leading retailers are using digital and analytical tools to significantly reduce indirect costs in the following areas:

Visibility of purchase expenditures

Advanced digital solutions are powered by artificial intelligence (AI) and machine learning, enabling retailers to quickly and accurately map relevant spending bases to specific categories, giving a clear understanding of who is spending the most money. Cutting-edge digital procurement solutions can pull purchase order (PO) and invoice data from multiple systems to create a “multi-dimensional expenditure data set”, automatically generate pricing and specification benchmarks, and icon dashboards and reports to help category managers Monitor spending. A retailer recently simplified its headquarters organization, but found that many costs have been covered by the use of contractors and temporary workers through artificial intelligence-backed spending plans. Once a retailer uses the agreed taxonomy to generate a spending cube, it can lock the baseline and view its spending with contract and non-contract suppliers.

Consumer insight

Retailers use digital consumer surveys and outsourced competitor data to understand, resolve, and re-evaluate consumer perceptions of store cleanliness. Which stores do consumers most often notice? What areas did they hardly notice? Analysis shows that parking lots and sidewalks are considered clean enough, so instead of hiring cleaners for thorough cleaning multiple times a day, retailers conduct spot checks on store employees every few hours. The survey also revealed places such as fitting rooms and footwear departments-retailers can do more frequent cleaning in these places to increase customer satisfaction. The Business Insight team then assessed the exact impact of these adjustments on retailer sales.

Value design

Retailers have reduced the cost of paper shopping bags by 25% through redesign. Through digital analysis of basket size, product size, and cashier survey data, the retailer determined the ideal size of the shopping bag based on the distribution of physical volume and product weight. Further digital analysis-and input from cashiers, bag makers and other suppliers-helped retailers get the basic composition, which will give shopping bags the appropriate level of puncture and tensile strength.

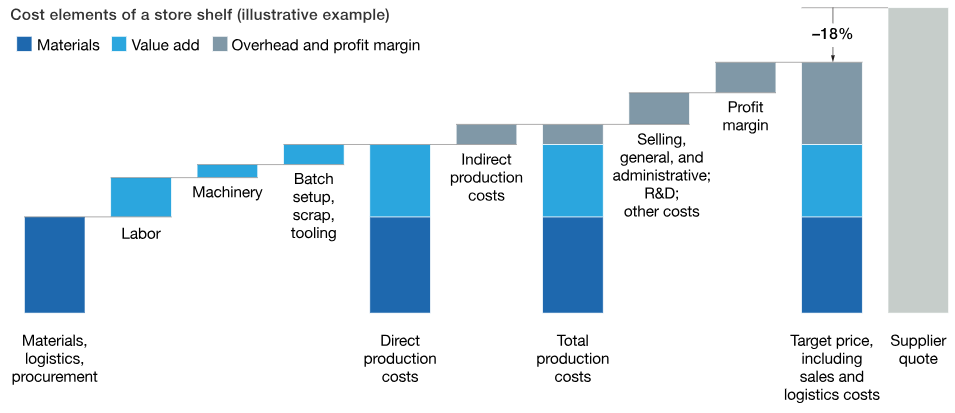

Cost-driven factor model

Digital cost driven factor modeling tools can reduce indirect costs by up to 40%. These tools often have algorithms for determining costs in various NFR regions, a dynamic database of input costs (such as raw material index prices), and complex calculation engines. Through a case study, a retailer found that it paid far more than the "Should Cost" of the store shelf (below).

Expenditure control

Digital purchase to payment tools allow retailers to better control spending by strengthening discipline in supplier setup and approval, and by supporting more stringent PO approval processes.

Zero Base Budget (ZBB)

Using digital tools (and by increasing spending visibility), retailers can easily build detailed bottom-up budgets, detect the exact drivers of variance, and take quick action to close the gap. ZBB initially had a place in consumer goods companies and could be powerful for retailers, especially the store-related NFR category. Identifying the appropriate budget for each store and then tracking compliance with that budget can lead to significant cost savings

Work closer with suppliers

Retailers should work with suppliers to improve costs and innovation. Vendors may be a good idea provider, because they know the retailer's bad habits better than the retailer itself, preferring to help change those habits rather than lose business. Retailers can also invest in improving supplier capabilities in the hope that retailers will pay multiple return on investment. The benefits of a strong supplier relationship include: better product quality and availability, faster response to market demand, less management effort, higher efficiency and lower total costs.

The elements of successful supplier cooperation include focusing on a limited number of suppliers to provide the highest return on investment, establishing a strong value-sharing agreement from the start, creating an independent supplier collaboration team, separate from the category manager, and There are strict performance management and benefit tracking systems.

When a retailer re-signed an outsourced warehousing contract, they asked the supplier to submit suggestions for improving the joint warehousing business. Based in part on these proposals, retailers will reduce their number of suppliers to two, thereby fostering closer collaboration while maintaining some competitive pressure. Retailers set goals for continuous improvement in their contracts and provided revenue incentives for suppliers. It has also invested in a “Lean Warehouse” team that works closely with suppliers to build capacity.

Complete it

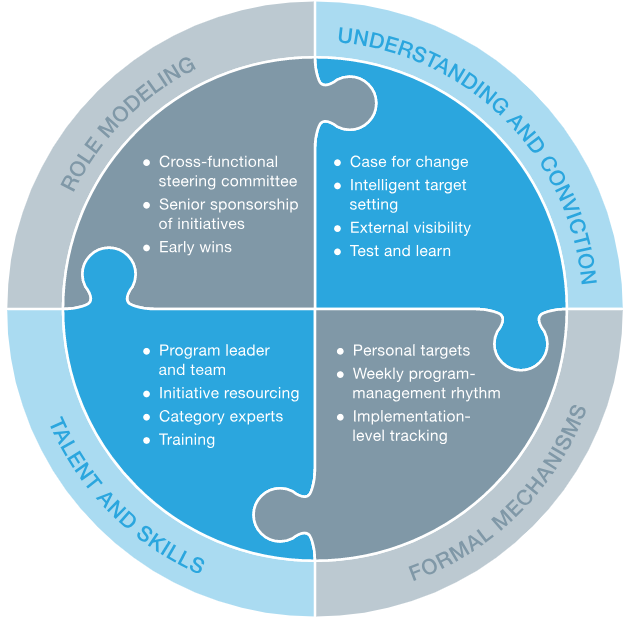

Retailers must embed these new ways of working into everyday tasks. In order to maintain continuous improvement, they must use all four parts of the "impact model" (pictured below).

Develop understanding and belief

Leading retailers provide a clear case for change and help every stakeholder connect with them on a personal level. An important aspect of the change story is to communicate why spending savings are needed and what they will be used for. Allowing business or functional departments to reinvest part of the savings can increase motivation. (One retailer's initiative leader put it this way: “Half are CFOs, but the other half are ours.”) Of course, headquarters should know enough about reinvestment to ensure that they align with business priorities and generate Strong returns.

Smart goal setting also helps promote understanding across the organization. The goal should be based on a detailed diagnosis, including benchmarking against relevant peer sets. Otherwise, stakeholders will reject arbitrary goals, and by pushing them towards “cutting” cost reductions, there is also a risk of damaging the business. Diagnostics should not only generate a goal-such as a $ 100 million cost savings-but also a series of quantified initiatives. The goal should include cost ratios (for example, logistics expenditure as a percentage of sales), not just absolute numbers, to ensure that cost efficiencies can really improve even when category management experiences adversity. (For example, lower logistics costs due to lower sales are not a real improvement.)

Because indirect procurement is often considered a resurgence, and purchasers can feel like they're working on a piece of cake, external visibility can be a strong driver. When retail CEOs advertise their NFR initiatives and goals, those involved in those initiatives will find their work important and even capable of affecting their company's stock price.

On the NFR journey, stakeholders sometimes resist change because of concerns about negatively affecting sales. An assessment and learning culture can overcome this. The first step can be to display a model or sample that suggests changes. A retailer's purchasing team suggested using thinner and cheaper paper as marketing material. It overcomes resistance from the marketing department by printing samples on thinner paper and using blind tests to prove that the materials are equally effective.

Develop talent and skills

The NFR plan requires competent project leaders and support teams. The project leader may start with a position role and should understand the business and be respected by senior management. Given this person's talents and leadership, it is not an easy decision for senior management to have him or her lead the program. But giving will pay off.

However, without sufficient resources for each initiative, the plan will be in trouble and colleagues in each function or cost category will need to spend 10% to 20% of their time on this work. For a $ 10 billion retailer, a $ 200 million savings would require a project leader and about 40 full-time employees (FTE) to work for 12 months. Company leaders must stop or suspend other programs to support the project. Although 40 FTE may sound like a huge investment, retailers still pay back these employees' year-long efforts by more than 50 times the investment.

Neither the project leader nor the team members can expect to have all the expertise in all relevant specific categories. Our research shows that compared with other industries, retailers have 8 times more indirect expenses per purchasing professional than other categories, which means that their professional level in any category is relatively low. Therefore, it is important to leverage internal and external category experts. A grocery retailer found that one of the project managers had been a refrigeration engineer for 25 years. The company introduced him to a team whose mission is to reduce the life-cycle costs of cooling, heating and refrigeration assets by 30% in two years. The team achieved the goal within six months and achieved it with a simple solution-for example, changing the type of price tag used in the refrigerated shelf so that the tag would not fall off and block the drain. This change has saved retailers more than $ 600,000 annually.

Capacity building is also critical. The best companies use a combination of classroom training, e-learning tools and on-the-job training. In our experience, many NFR professionals who receive function- and category-specific training and mentoring immediately double or triple their effectiveness. Phased training-Trainer approach-Purchasing team trained during the pilot phase, applying learning to the initial category, and then training others as coaches in the next phase-proved effective in many cases.

The power of role models

The CEO, CFO, and other members of the management team must work together to convey the power of change cases and the ideal thinking and behavioral role models to the desired audience. As a cross-functional steering committee, they can remove obstacles, expose opportunities and capture cross-functional collaboration opportunities, and allocate sufficient resources to them to send a clear message to the organization on the importance of these initiatives.

Another powerful role model is senior sponsorship of the program. Senior leaders can serve as coaches for the initiative owners of individual categories, whether they are within or outside the scope of their respective functions.